The situation faced by Arcom during the FIFA World Cup 2022 in Qatar presents a challenging conundrum. While the regulator aims to curb illegal streaming of football matches by blocking domains associated with piracy, it must also consider the unintended consequences of cracking down too harshly on fans who may resort to illegal streams out of convenience or necessity.

The dilemma arises from the fact that many fans who engage in illegal streaming are also potential customers for legitimate, paid services. By targeting the most prolific football pirates, Arcom risks alienating these fans and driving them further away from legal options. This could ultimately undermine efforts to promote legal consumption of sports content and generate revenue for rights holders.

Furthermore, the effectiveness of domain blocking measures may be limited, as determined pirates can easily circumvent such restrictions by accessing content through alternative means or platforms. This highlights the need for a multifaceted approach to combatting piracy that includes education, enforcement, and the promotion of affordable and accessible legal alternatives.

Ultimately, Arcom must strike a balance between protecting the interests of rights holders and ensuring that football fans have access to the content they want in a convenient and affordable manner. This may involve collaborating with stakeholders across the industry to develop strategies that address the root causes of piracy while fostering a supportive environment for legal consumption.

Arcom’s study provides valuable insights into the viewing habits of French citizens during the World Cup 2022. The fact that more than six out of 10 people watched or listened to at least one live match highlights the widespread popularity of the tournament in France.

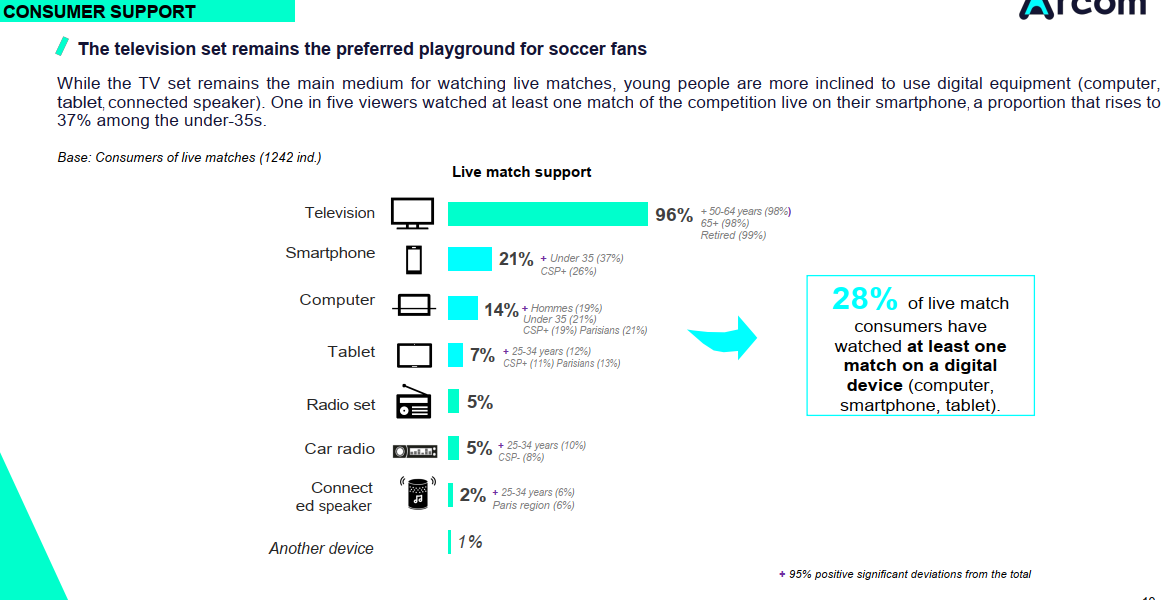

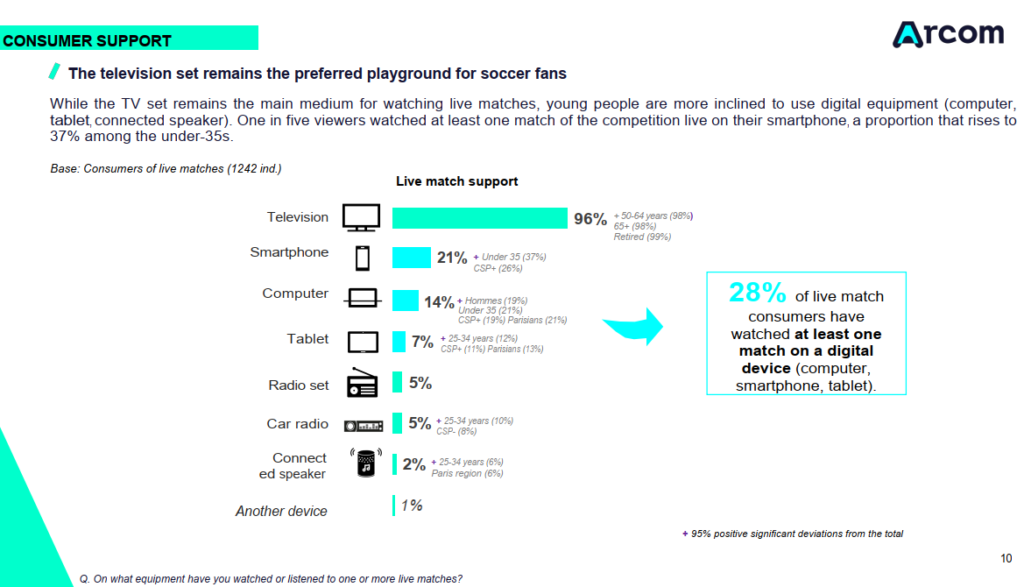

Television remains the dominant medium for consuming live matches, with a staggering 96% of respondents choosing this option. This reaffirms the enduring appeal of traditional broadcasting methods for major sporting events, providing viewers with a communal viewing experience and high-quality coverage.

However, the study also indicates a growing trend towards digital consumption, with around one in five football fans opting to watch matches on smartphones. This reflects the increasing prevalence of mobile devices in everyday life and the convenience they offer for accessing content on the go.

Additionally, the findings suggest that there is still room for growth in digital viewing, as only a small percentage of respondents watched matches on computers or tablets. This presents an opportunity for broadcasters and rights holders to further expand their digital offerings and reach a wider audience through online platforms.

Overall, Arcom’s research underscores the importance of understanding consumer behavior and preferences in shaping the future of sports broadcasting. By catering to evolving viewing habits and embracing digital innovation, stakeholders can enhance the World Cup experience for fans and maximize the tournament’s financial benefits for France.

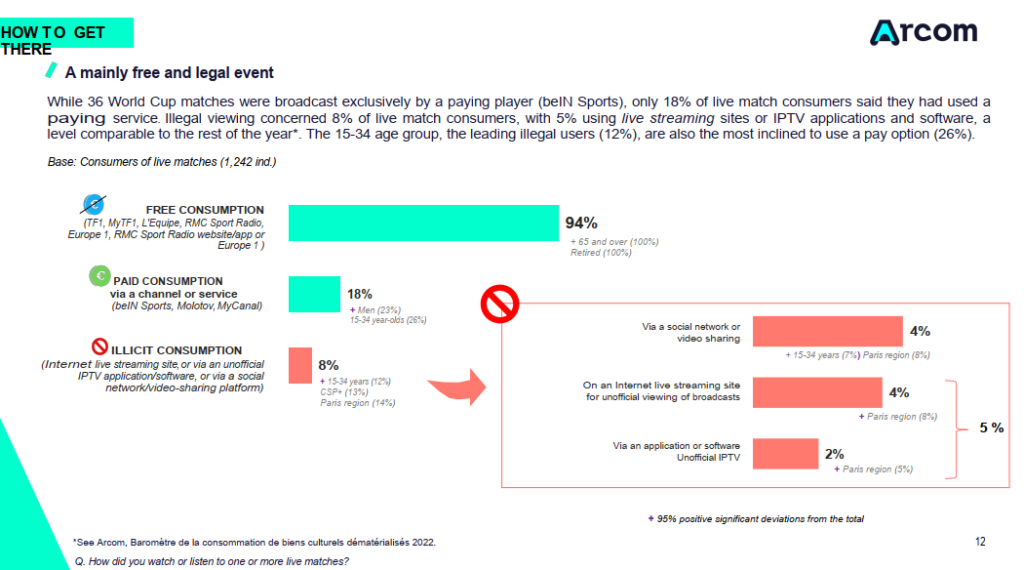

The requirement for certain World Cup matches to be broadcast on widely accessible platforms in France reflects the country’s commitment to ensuring that citizens have free access to important cultural and sporting events. This ensures that football, a beloved sport for many, remains accessible to all, regardless of financial status.

TF1’s broadcasting of these matches allowed the majority of viewers to watch legally and for free, with 87% of live match consumers tuning in via this channel. This demonstrates the effectiveness of making key matches available on free-to-air television in reaching a broad audience and promoting inclusivity.

However, the situation changes when matches are exclusively aired on subscription-based platforms like beIN Sports. With more than half of the tournament matches behind a paywall, it creates a situation where piracy becomes more prevalent. The study’s findings indicate that 18% of live match consumers watched matches using paid services, while 8% resorted to illegal platforms. This underscores the impact of access restrictions on driving viewers towards unauthorized sources to watch matches.

Efforts to balance revenue generation with accessibility are crucial in addressing the issue of piracy. By ensuring a mix of free and subscription-based options for viewers, stakeholders can mitigate the incentives for piracy while still generating revenue from premium content. Additionally, exploring innovative models, such as bundled subscriptions or pay-per-view options, could offer viewers flexibility while protecting the value of licensed content.

Arcom’s dilemma highlights the complex relationship between piracy and legal consumption, especially among younger demographics. The data indicating that the 15-34 age group, while comprising the leading demographic for illegal consumption (12%), also represents the highest proportion of users inclined to opt for legal pay options (26%) underscores this challenge.

This overlap between engagement in both legal and illegal consumption is not uncommon and has been observed in numerous studies, including recent findings from the EU, which reported that 60% of pirates also purchase content legally. This indicates that efforts to combat piracy must consider the diverse motivations and behaviors of consumers, particularly within key demographic groups.

In the short term, site-blocking measures may serve as a means to address piracy during events like the World Cup. However, the effectiveness of such measures may be limited, especially given the widespread availability of VPNs and proxy services that allow users to bypass these blocks. Moreover, the impact of site-blocking on legitimate viewers who may inadvertently access blocked sites should be considered.

Ultimately, a more holistic approach that addresses the underlying factors driving piracy, such as access restrictions and pricing models, may be necessary. By offering a mix of free and subscription-based options, stakeholders can cater to different consumer preferences while minimizing the incentives for piracy. Additionally, investing in innovative content distribution strategies and anti-piracy technologies can help strike a balance between protecting intellectual property rights and providing accessible, engaging content experiences for audiences.